Israel and Iran Are Now at War, Here’s Why It Matters to You

After years of indirect conflict, Israel and Iran have entered a direct military conflict. Americans are already feeling the impact in their wallets.

On June 13, Israel attacked several Iranian nuclear and missile sites, including Natanz. Natanz is a massive underground facility where Iran enriches uranium, a key ingredient for nuclear power or, potentially, nuclear weapons. Israeli leaders claimed new satellite images showed Iran rapidly approaching nuclear weapons capability, leaving them no diplomatic options.

Iran responded quickly by launching long-range ballistic missiles, hitting Israeli cities like Tel Aviv and Haifa, and striking oil facilities.

Both countries claim self-defense. Israel fears an Iranian nuclear bomb threatens its survival. Iran, which refuses to recognize Israel, sees the Israeli strikes as an attack on its sovereignty. With neither side backing down, the conflict has exploded into open war.

How Does a Distant War Hurt Americans?

About 25% of the world’s oil, approximately 21 million barrels each day, passes through a critical shipping lane called the Strait of Hormuz, which is just 21 miles wide at its narrowest point. Iran regularly threatens to block this key route during conflicts, causing oil traders to panic and prices to spike as soon as fighting starts.

Immediately after the attacks, oil prices jumped over 7%, pushing U.S. crude oil to around $73 per barrel. Patrick De Haan from GasBuddy warns that if fighting continues, American gas prices could rise by another 10 to 25 cents per gallon. According to AAA, the national average is already up five cents this week, at about $3.17 per gallon.

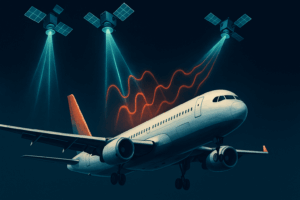

In everyday terms, filling up a typical midsize car now costs around 75 cents more. If the situation worsens, it could cost two to four dollars extra per fill-up. Higher fuel costs also affect airlines and trucking companies, meaning groceries, airfare, and deliveries could become more expensive soon.

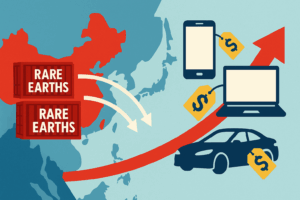

Economists warn that rising fuel costs might trigger broader inflation, pressuring the Federal Reserve to keep interest rates high.

Shipping insurance and freight costs are also increasing. About 20% of global oil tankers and many cargo ships must travel through Hormuz. Companies like Japan’s Mitsui O.S.K. Lines have warned they might charge extra fees if attacks escalate.

Cyberattacks are another serious concern. Whenever Gulf tensions rise, U.S. banks and power companies report more hacking attempts from Iran. Even minor cyber disruptions could impact banking, online shopping, and electricity grids far from the actual warzone.

Ultimately, this war initially over Iran’s nuclear ambitions is already costing Americans at the gas pump, increasing prices for goods shipped across the country, shaking confidence in stock markets, and raising the likelihood of cyberattacks. Until peace returns or oil shipping lanes feel safe again, everyday Americans will continue paying both obvious and hidden costs of a conflict half a world away.